What Are Trade Alerts? An Easy Guide for Traders in 2025

Whether you’re new to trading or looking to optimize your strategy, you’ve probably heard about trade alerts.

But what exactly are they, and how can they improve your trading results?

Trade alerts have become essential tools for modern traders, offering real-time notifications about market opportunities.

However, not all alerts are created equal, and understanding their different types, benefits, and limitations is crucial for making informed decisions.

Let’s dive into everything you need to know about trade alerts and how to use them effectively in your trading journey.

What Are Trade Alerts?

Trade alerts are real-time notifications that inform traders about specific market opportunities, entry and exit points, or significant market movements. These alerts can be delivered through various channels including SMS, email, mobile apps, Discord, or specialized trading platforms.

At their core, trade alerts serve as a bridge between market analysis and trading execution, helping traders:

- Identify opportunities they might have missed

- Act quickly on time-sensitive trades

- Learn from experienced traders’ strategies

- Stay informed even when away from their trading screens

Trade alerts typically include essential information such as:

- Stock symbol or instrument

- Recommended action (buy, sell, hold)

- Entry price or price range

- Target price levels

- Stop loss recommendations

- Risk management guidelines

Types of Trade Alerts

1. Manual vs. Automated Alerts

Manual Alerts: Created by human traders or analysts who manually send notifications based on their market analysis and experience.

Automated Alerts: Generated by algorithms, technical indicators, or trading systems that trigger notifications when specific conditions are met.

2. By Trading Style

Day Trading Alerts: Focus on short-term opportunities, often lasting minutes to hours.

Swing Trading Alerts: Cover medium-term trades lasting days to weeks.

Options Trading Alerts: Specifically target options contracts with strike prices, expiration dates, and strategy recommendations.

Forex Alerts: Focus on currency pairs and foreign exchange opportunities.

3. By Source

Signal Services: Professional providers who offer alerts as a subscription service.

Trading Communities: Discord groups, forums, or social platforms where traders share ideas.

Brokerage Alerts: Notifications from your broker about price movements, news, or account activity.

Personal Alerts: Custom notifications you set based on your own criteria and technical analysis.

How Trade Alerts Work

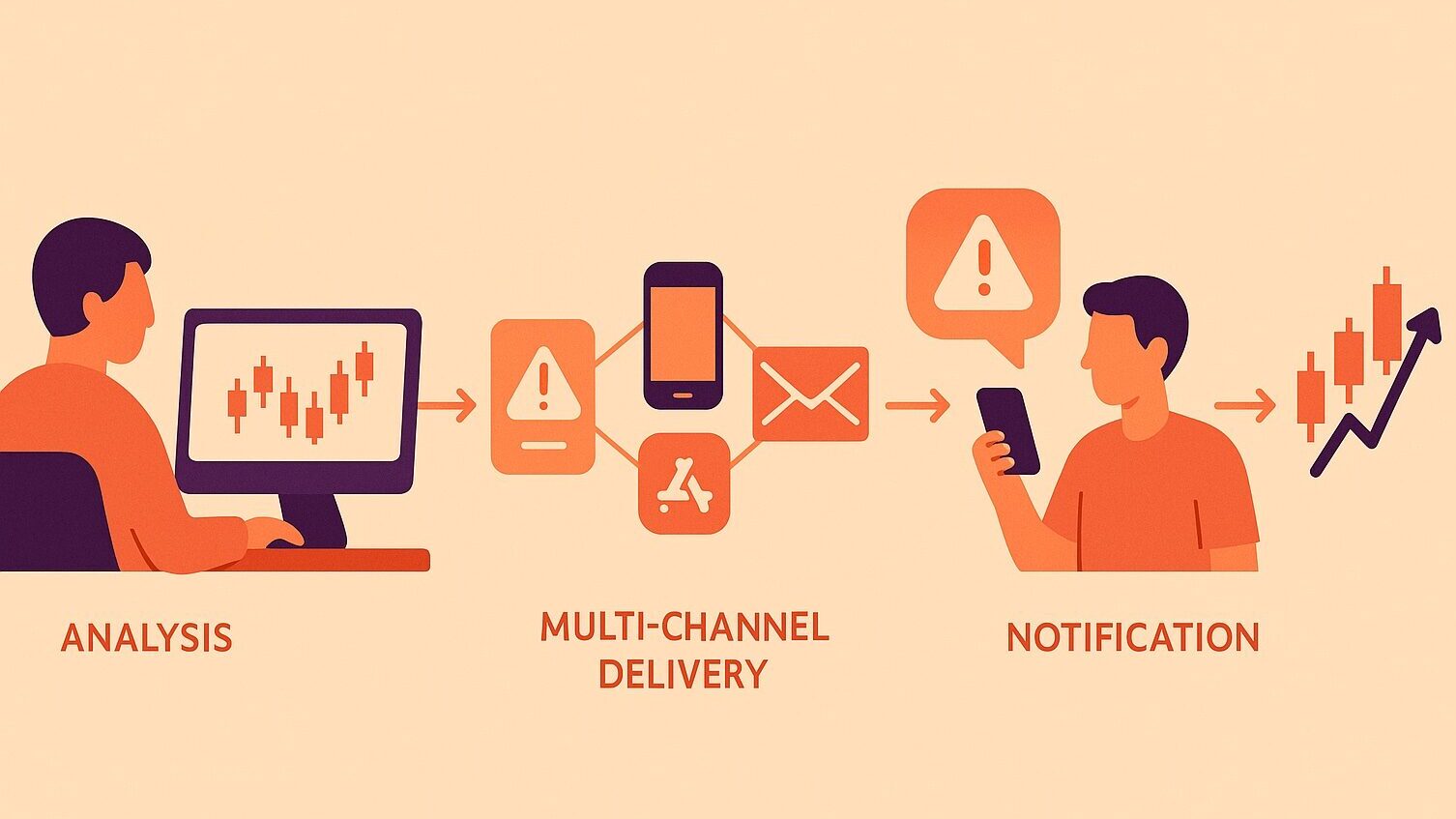

The process typically follows these steps:

- Analysis: The alert provider (human or algorithm) analyzes market conditions using technical analysis, fundamental analysis, or both.

- Trigger: When specific criteria are met, an alert is generated and sent to subscribers.

- Delivery: Alerts are distributed through chosen communication channels within seconds or minutes.

- Action: Traders receive the alert and decide whether to execute the recommended trade based on their own risk tolerance and strategy.

- Follow-up: Some providers offer updates on active positions, exit strategies, or performance summaries.

Modern platforms like Skippa have revolutionized this process by automatically verifying trades directly from mentors’ brokerage accounts, ensuring alerts reflect real trades rather than hypothetical ones.

Benefits of Using Trade Alerts

1. Time Efficiency

Trade alerts save countless hours of market scanning and analysis. Instead of monitoring multiple charts and indicators, you receive curated opportunities directly.

2. Learning Opportunities

Following experienced traders’ alerts helps you understand their decision-making process, risk management techniques, and market analysis methods.

3. Market Coverage

Alerts can cover markets, sectors, or instruments you might not typically monitor, expanding your trading opportunities.

4. Emotion Management

Pre-planned alerts can help reduce emotional decision-making by providing clear entry and exit criteria.

5. Accessibility

Trade alerts make advanced trading strategies accessible to beginners who are still developing their analytical skills.

Common Types of Information in Trade Alerts

Effective trade alerts typically include:

Basic Information:

- Asset symbol (AAPL, SPY, etc.)

- Action (buy, sell, watch)

- Current price

- Timestamp

Trading Details:

- Recommended entry price

- Target profit levels

- Stop loss levels

- Position size suggestions

- Risk-reward ratio

Context:

- Reasoning behind the trade

- Technical levels to watch

- Market conditions

- News catalysts

- Time frame for the trade

How to Evaluate Trade Alert Services

When choosing a trade alert provider, consider these factors:

1. Track Record Transparency

Look for providers who share verified performance data, not just screenshots. Third-party verification platforms or direct brokerage integration provide the most credible proof.

2. Real-Time Delivery

Ensure alerts arrive quickly enough to be actionable. Delayed alerts in fast-moving markets can be worthless.

3. Risk Management

Quality providers emphasize position sizing, stop losses, and proper risk management alongside their trade recommendations.

4. Educational Value

The best alert services explain their reasoning, helping you learn rather than just follow blindly.

5. Consistency

Look for providers with consistent performance over extended periods, not just cherry-picked winning trades.

6. Transparency About Losses

Honest providers acknowledge their losing trades and use them as learning opportunities.

Common Mistakes When Using Trade Alerts

1. Blind Following

Never execute trades without understanding the reasoning behind them or ensuring they fit your risk tolerance.

2. Ignoring Risk Management

Alert recommendations are meaningless without proper position sizing and stop loss implementation.

3. FOMO Trading

Don’t chase alerts that arrive after significant price movements have already occurred.

4. Over-Reliance

Use alerts as a supplement to your own analysis, not a replacement for developing trading skills.

5. Not Verifying Sources

Always research alert providers and verify their claims before trusting them with your capital.

Trade Alerts vs. Trading Education

While trade alerts can be valuable, they shouldn’t replace comprehensive trading education. Consider alerts as:

Short-term: Immediate trading opportunities Long-term: Learning tools to develop your own trading skills

The most successful traders use alerts to:

- Supplement their own analysis

- Learn new strategies and market perspectives

- Stay informed about opportunities in unfamiliar markets

- Manage time more efficiently

But they continue developing their own analytical skills and market knowledge.

Technology and the Future of Trade Alerts

The trade alert industry continues evolving with new technologies:

Real-Time Verification: Platforms now offer direct brokerage integration to verify that alerts represent actual trades, not just recommendations.

AI and Machine Learning: More sophisticated algorithms can identify patterns and generate alerts based on complex market conditions.

Mobile Integration: Smartphone apps provide instant notifications with the ability to execute trades directly from the alert.

Community Features: Social trading platforms combine alerts with community discussion and verification features.

Blockchain Integration: Some platforms are exploring blockchain technology for immutable trade verification and transparent performance tracking.

Best Practices for Using Trade Alerts

1. Start Small

Begin with small position sizes while you evaluate an alert service’s quality and fit with your trading style.

2. Keep Records

Track which alerts you follow, their outcomes, and what you learn from each trade.

3. Maintain Your Own Analysis

Use alerts to confirm or challenge your own market analysis rather than replacing it entirely.

4. Set Clear Criteria

Decide in advance which types of alerts align with your strategy, risk tolerance, and available capital.

5. Stay Educated

Continue learning about markets, technical analysis, and trading strategies even while using alert services.

Choosing the Right Alert Service for You

Consider these factors when selecting a trade alert provider:

Trading Style Alignment: Ensure the service matches your preferred trading timeframe and risk level.

Verification Methods: Look for services that provide transparent, verifiable track records.

Communication Style: Choose providers whose explanations and teaching style resonate with your learning preferences.

Support and Community: Consider whether you want additional educational resources, community interaction, or customer support.

Technology Integration: Evaluate if the delivery method (app, email, SMS) fits your trading routine.

Final Thoughts: Making Trade Alerts Work for You

Trade alerts can be powerful tools when used correctly, but they’re not magic solutions for trading success. The best approach combines quality alerts with your own market knowledge, proper risk management, and continuous learning.

Remember that successful trading requires more than just knowing what to buy—it requires understanding when to sell, how much to risk, and how to manage emotions throughout the process.

Whether you’re just starting with trade alerts or looking to improve your current approach, focus on finding transparent, educational providers who prioritize your long-term success over short-term profits.

Looking for trade alerts you can actually trust? Skippa provides verified, real-time alerts directly from successful traders’ brokerage accounts, eliminating guesswork and fake screenshots. Schedule a demo to see how transparent, verified trade alerts can improve your trading results.

Ready to experience verified trade alerts? Join traders who prioritize transparency and real results over flashy promises.